It's Not Just Questions About The Metal In The Fed's Vault but the many possible claims against it

Time To Audit The Taxpayer's Gold Held By The Fed

I find it amusing that the discussion about the U.S. revaluing it’s gold to shore up the Treasury’s balance sheet is based on the assumption that gold is still there. We know Germany had questions about that back in 2013 and it took them over three years to get just 300 tons of the 1500 tons then held by the Fed. And much of that gold was not in the form that was sent to the U.S. for “safekeeping.”

If the gold still exists, 43% of it was moved out of Ft Knox to various locations, most predominant the Denver Mint and West Point (Treasury-Owned Gold). Before we can discuss revaluing the gold, it must be determined how much of that gold is actually sitting in the vaults and in what form:

Fort Knox ran out of good delivery gold in March 1968 after it was drained by a cartel of London and French banks under the guise of defending the London Gold Pool. 1000s of tonnes of U.S. Treasury gold were flown over in U.S. Air Force C-130s to RAF Mildenhall and transported in convoys down to the Bank of England in London and then given out to the Market via the 5 bullion banks at $35 per oz. (there’s more here: BullionBrief and here - hat tip to Ronan Manly for his indefatibably tenacious research)

There’s also this:

Over 80% of all claimed US Treasury holdings are not good delivery gold. Nearly everything claimed to be in Fort Knox and Denver is coin melt, and a lot of the bars at West Point are coin melt also. The rest of the tweet is here: BullionBrief

In addition the issues of “where,” “how much” and “in what form,” is the issue of rehypothecation, or the possibility probability that there are multiple claims in the form of leases and swaps on the gold that may or may not be sitting in the Fed’s vaults.

GATA’s Chris Powell took a dive into this topic:

London's Daily Mail has jumped on Elon Musk's interest in whether the U.S. government still has gold reserves at Fort Knox in Kentucky --

https://www.dailymail.co.uk/news/article-14403697/gold-reserve-doge-audit-fort-knox-elon-musk.html

-- but no one yet seems to be addressing the key detail.

The big issue is not so much whether gold remains in the depository as much as whether it is encumbered by leases or swaps undertaken by the Federal Reserve or the Treasury Department. That is, the big issue is whether U.S. gold reserves are, to put it politely, oversubscribed, along with the gold the Federal Reserve Bank of New York has held as custodian for other nations.

Just as experts have said the London and New York gold markets trade as much as 100 times the metal actually available for delivery there, with each ounce of real metal supporting scores of derivative claims to it, what is the U.S. government's true position in gold in domestic and international markets?

During its freedom-of-information litigation against the Federal Reserve in 2009 GATA extracted an admission that the Fed had secret gold swap arrangements with foreign banks:

https://www.gata.org/node/7819

The Fed refused to detail those arrangements.

In 2012 gold researcher Ronan Manly obtained the secret 1999 report of the staff of the International Monetary Fund confirming that the IMF was allowing its member central banks to include their gold swaps and leases as part of their official gold reserve totals so markets would not discover how much official gold had been deployed for price suppression:

https://www.gata.org/node/12016

That's one reason -- there are others -- why official gold reserve data is not reliable and, indeed, why a mere inspection of the vaults at Fort Knox or any other official depository can never be dispositive.

Only a full audit of possible encumbrances of the U.S. gold reserve or any gold reserve can establish the status of the reserve and tell the story of gold market intervention.

How much gold has been shorted by the U.S. government in the last 50 years of gold price suppression policy? That is the question that Elon Musk and his Department of Government Efficiency should try to answer.

In the meantime, GATA may be forgiven for suspecting that the supposed frantic shipments of gold to the United States from London and other locations have nothing to do with the fear of tariffs but everything to do with a desperate rush to recover gold used during by many years of naked shorting under price suppression policy.

Here’s the link to this GATA dispatch: Status of the Treasury’s Gold

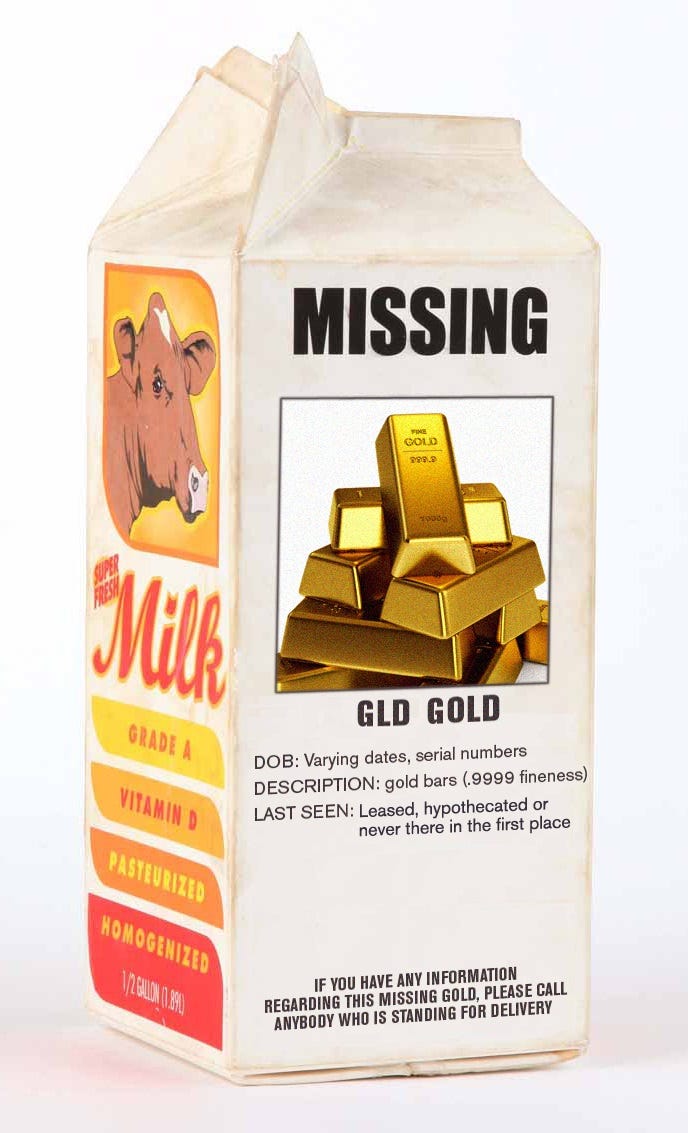

Got Milk?

It’s like having a lip-gloss babe in your 911…only she is rented.